Best Investment Options in the UAE

Where You Can Invest in Dubai and Other UAE Cities

The UAE is one of the world’s most attractive investment hubs, offering strong economic stability, tax advantages, and opportunities across real estate, gold, stocks, bonds, ETFs, REITs, and crypto. This guide explains each investment option, expected returns, risks, and how non-residents can invest smoothly — including how 1tab supports large transfers for property and business deals.

The UAE remains one of the most attractive destinations for investors in 2025. Its stable economy, tax advantages, and open business environment make it ideal for both local and foreign investors. Dubai and Abu Dhabi continue to grow as global financial and real estate hubs, while smaller emirates like Sharjah and Ras Al Khaimah offer opportunities in trade, tourism, and manufacturing.

The tax system remains favorable — in most cases, there is no income tax, and the corporate tax rate (9%) applies only to profits above a certain threshold. The country also actively supports entrepreneurs, from free economic zones to digital platforms for business registration.

Can Non-Residents Invest in Dubai or Other UAE Cities

Non-residents can invest in real estate in Dubai (and many other cities across the UAE). Still, there are important conditions: only properties located in officially designated “freehold” zones are eligible. Moreover, while a UAE residency visa is not required to purchase property, buyers must have a valid passport and the deal must be registered with the local land registry (the Dubai Land Department — DLD).

In practice, this means foreign investors often need a local intermediary (a real-estate broker or legal representative) to handle paperwork and sign the purchase agreement, especially if they’re abroad.

1tab enables safe cross-border transfers for real-estate deals. Send funds in any currency or cryptocurrency (BTC, ETH, USDT), and 1tab will issue a manager’s cheque or provide AED/USD in Dubai. This ensures smooth, bank-compliant settlement for non-residents purchasing property in the UAE.

Best Options for Investments in the UAE

Real Estate

Dubai, Abu Dhabi, and Sharjah are the main hubs, while emerging emirates like Ras Al Khaimah and Ajman offer lower entry points.

The Dubai residential real estate market continued its upward trend, with REIDIN reporting a 15.60% year-on-year increase in the residential property price index. In annual terms, apartment prices rose by 15.22%, while villa prices went up by 17.81%.

Dubai, Abu Dhabi, and Sharjah are the largest real-estate markets, with annual price growth of 15–18% for apartments and villas.

Property prices in Dubai for prime locations like Downtown, Business Bay, and Palm Jumeirah range from $3,000 to $12,000 per m² for apartments and $6,000 to $20,000 per m² for villas. Abu Dhabi luxury villas can reach $10,000–$15,000 per m².

Rental yields average 5–7% annually for apartments and 4–6% for villas, depending on the location and property type. Short-term vacation rentals in tourist areas can reach 8–10% during peak season.

Foreign investors often face hurdles when transferring large sums to banks in the UAE. Here’s how 1tab simplifies the process: choose a property and discuss details with your broker or developer. After that, send funds to 1tab in any currency or cryptocurrency (BTC, ETH, USDT), and we will provide you with cash in our Dubai office.

If you want to pay for a property using a manager’s cheque, contact our manager on Telegram, and we will provide you with the available options.

Tips for real estate investors in the UAE:

Always verify that the developer is licensed and registered with the UAE Real Estate Regulatory Agency (RERA).

Consider short-term rental potential and location demand — coastal properties in Dubai Marina or Palm Jumeirah yield higher seasonal returns.

Legal documents, including the sales and purchase agreement, title deed, and FET forms (for foreign currency transfers), are essential for a smooth transfer of ownership.

Pros

High rental yields and strong long-term demand.

Freehold ownership is available for foreigners in designated zones.

No property tax or capital gains tax.

Cons

Upfront costs are high (DLD fee, agency fee, maintenance charges).

Non-residents face limits on mortgages and require local documentation.

Remote buyers often need an intermediary to handle payments and manager’s cheques.

Gold

Gold remains a core hedge asset in the UAE. The Central Bank of the UAE boosted its gold reserves by roughly 26% in the first five months of 2025, bringing total holdings to around $7.9 billion.

In 2025, global spot prices passed $3,000/oz, and in Dubai, the 22-karat price rose to AED 391.25 per gram. Local demand for investment bars grew significantly, with a 25% year-on-year increase in the UAE during Q2 2025.

Investors should buy only from accredited dealers, compare spot prices in AED, review premiums, and consider storage costs. Gold works best as a 3–10% stabilizer within a diversified portfolio.

Practical Steps to Invest:

Visit a reputable dealer in Dubai or Abu Dhabi, or use a certified online platform that delivers bullion with full documentation.

Check the spot price in AED or USD, ensure it’s investment-grade (e.g., 24K or 22K), and check storage or vaulting costs if you don’t take delivery yourself.

Stay aware of buy-back spreads and premiums—while gold may be tax efficient, selling margins or physical logistics can dent returns.

Consider this rule of thumb: hold gold as a 3%–10% portion of your total portfolio when your primary goal is risk mitigation, not high income.

Gold works best when you expect rising inflation or currency depreciation, global economic or geopolitical shocks, or a need for a physical, portable asset in a location like the UAE.

Gold is less suitable if your main goal is high recurring income or fast growth—functions better handled by real estate, stocks, or business investment.

Pros

Safe-haven asset in uncertain markets.

High liquidity; easy to buy or sell in the UAE gold souks.

No tax on gold purchases for investment-grade products.

Cons

No passive income — profits rely on price growth.

Prices can be volatile during global uncertainty.

Storage and insurance costs for physical gold.

UAE Stock Market

Investing in the UAE stock market gives you exposure to the region’s fastest-growing sectors, including banking, real estate, tourism, and energy. For expats and international investors, it’s a way to tap into local economic growth without directly managing physical assets.

The DFM and ADX exchanges provide access to banking, real estate, energy, and tourism sectors. In 2025, ADX returned +12% YTD and DFM +9%.

Stock market returns are volatile. Prices can fluctuate due to global oil markets, currency shifts, and regional economic policies. Dividend yields in UAE equities are moderate—typically 2–5% annually—so this is more suitable for long-term growth than immediate cash flow. Foreign investors must provide KYC documentation, including ID, proof of address, and source of funds.

Practical Steps to Invest:

Open an account with a licensed UAE brokerage—many accept international IDs and bank verification.

Research companies listed on DFM or ADX, focusing on blue-chip stocks for stability or mid-caps for growth potential.

Fund your brokerage account in AED or USD.

Consider ETFs or mutual funds if you prefer diversified exposure with professional management.

Pros

Easy entry through DFM and ADX with low minimums.

Strong blue-chip companies with steady dividends.

Regulated and transparent market.

Cons

Market volatility can impact short-term returns.

A limited number of large tech companies compared to the US markets.

Requires NIN number and local broker setup.

Bonds

Bonds in the UAE are a conservative investment option that offers predictable income and portfolio diversification. Both government and corporate bonds are available to domestic and foreign investors.

The UAE government issues bonds and sukuk (Islamic bonds) to fund infrastructure and development projects. Corporate bonds are issued by leading companies across sectors such as banking, utilities, and real estate.

Typical yields for UAE government bonds in 2025 range from 3% to 4% annually, depending on maturity. Corporate bonds may offer 4–6% but have higher credit risk.

Most bonds are issued in AED or USD, making them accessible for international investors without currency conversion risks.

Practical Steps to Invest:

Open a brokerage or bank account in the UAE that supports bond purchases. Many banks facilitate international investors with minimal paperwork.

Decide between government bonds, corporate bonds, or sukuk based on risk tolerance and income goals.

Choose bond maturity: short-term bonds (1–3 years) offer liquidity, while long-term bonds (5–10 years) typically provide higher yields.

Consider laddering bonds—buying bonds with staggered maturities—to maintain liquidity while maximizing returns.

Bonds are sensitive to changes in interest rates. If rates rise, the market value of existing bonds may decline. Liquidity varies: some corporate bonds may not trade frequently, making early exits challenging. Currency risk arises when bonds are issued in AED or another currency while your base currency differs from that currency.

Pros

Stable and predictable returns.

UAE government bonds are considered very low risk.

Good option for capital preservation.

Cons

Lower returns compared to stocks or real estate.

Long lock-in periods for some bonds.

Early exit may not always be possible at face value.

Mutual Funds

Mutual funds provide diversified exposure to the UAE and global markets with professional management. Entry can be as low as $1,000.

Equity funds historically deliver 6–12%, balanced funds 4–8%, and money-market funds 2–3%. Investors complete standard KYC and select funds aligned with their risk profile and investment horizon.

Practical Steps to Invest:

Choose a licensed provider in the UAE, such as ADCB, Emirates NBD, or Noor Bank. International platforms such as HSBC and UBS also offer UAE-focused funds.

Determine your investment goals and risk tolerance to select between equity, bond, or balanced funds.

Complete KYC documentation, including a passport copy, proof of residence (if required), and source of funds verification.

Decide on the investment amount and the contribution frequency—either one-time or recurring.

Monitor performance periodically and adjust your holdings based on market conditions or financial goals.

Mutual funds charge management fees (usually 0.5–2%) and sometimes performance fees. Past performance is not a guarantee of future returns, so diversify and consider your investment horizon. Most funds allow monthly or quarterly redemptions, but some long-term funds may lock in capital for several years.

Pros

Professional management.

Diversification across regions and sectors.

Accessible through most UAE banks.

Cons

Higher fees compared to ETFs.

Not all funds outperform the market.

Less control over investment strategy.

ETFs (Exchange-Traded Funds)

In the UAE, ETFs provide an accessible way for expats and non-residents to diversify without buying individual securities.

The Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) list ETFs covering local indices, regional equities, and international markets. Popular UAE ETFs track indices such as the DFM General Index, the ADX General Index, and regional MSCI indices.

Entry thresholds are low: investors can purchase a single ETF share, often starting at $100–$200. Annual returns ranging from 6–10% for equity ETFs and 2–5% for bond/commodity ETFs.

Practical Steps to Invest:

Open a brokerage account with a licensed UAE broker or an international platform offering access to DFM/ADX ETFs.

Complete KYC checks, including passport, proof of residence (if required), and source of funds verification.

Choose ETFs based on your risk tolerance, asset class, and investment horizon.

Place buy orders directly on the exchange during market hours.

Monitor your holdings regularly, and consider selling or rebalancing based on market performance.

Pros

Low fees and high diversification.

Easy to buy and sell on exchanges.

Transparent structure and holdings.

Cons

Still subject to market volatility.

Some ETFs have low liquidity in the UAE.

A passive strategy may limit upside in fast-moving markets.

Real Estate Investment Trusts (REITs)

REITs are companies that own, manage, and generate income from real estate assets. In the UAE, investors can gain exposure to the property market without directly buying physical property, making it a convenient option for non-residents and expats.

REITs in the UAE are regulated by the Securities and Commodities Authority (SCA) and listed on the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX). They invest in office buildings, retail spaces, warehouses, hotels, and mixed-use developments across Dubai, Abu Dhabi, and other Emirates.

Average dividend yields range between 6% and 9% annually. Some popular REITs include Emirates REIT, ENBD REIT, and Al Mal REIT, offering both commercial and residential properties.

Practical Steps to Invest:

Open a brokerage account with a licensed UAE broker or an international platform that lists UAE REITs.

Complete KYC procedures, including passport, proof of residence (if required), and source of funds verification.

Analyze REIT portfolios, dividend history, and management track record before investing.

Place buy orders during market hours and monitor dividends and performance.

Reinvest dividends or diversify across multiple REITs to maximize returns.

REIT values fluctuate with the property market, so investment carries risk. Dividend payments are not guaranteed and depend on occupancy rates, rent collection, and operational costs. REITs are exposed to macroeconomic factors like interest rate changes, tourism, and demand for office or retail space.

Pros

Exposure to real estate without owning physical property.

Regular dividend payouts from rental income.

Lower entry cost compared to buying a property.

Cons

Vulnerable to commercial real estate cycles.

Limited number of REITs in the UAE.

Dividends may fluctuate with occupancy rates.

Cryptocurrency

Cryptocurrency has gained significant traction in the UAE, especially in Dubai and Abu Dhabi, where regulators encourage innovation while enforcing compliance. Investors can buy Bitcoin (BTC), Ethereum (ETH), USDT, and other major cryptocurrencies.

Dubai hosts licensed exchanges and crypto-friendly zones, such as the Dubai Multi Commodities Centre (DMCC), which offers a regulatory framework for crypto trading and custody. Major exchanges operating in the UAE include Binance MENA, Rain, BitOasis, and eToro UAE.

For investors looking to convert crypto into UAE-ready funds, 1tab provides a fast and secure solution. Here’s how it works:

Submit a request through the 1tab website or via the Telegram bot.

Complete a quick verification — a passport or ID card is enough. You’ll take a selfie and fill out a short form.

Select the amount, currency, and pick-up city.

Receive instructions from your 1tab manager on where to send the crypto and how to collect your funds.

Make the transfer and receive your money most conveniently — in cash or to a bank account.

The service complies with all UAE AML and KYC regulations, ensuring your transaction is entirely legal.

Choose a licensed exchange or OTC provider, such as 1tab, for large transfers to avoid delays or compliance issues. Keep a clear record of transactions and proof of origin for regulatory purposes. Split investments across multiple cryptocurrencies or combine crypto with traditional assets to balance risk and reward.

Pros

The UAE has clear regulations and licensed exchanges.

High liquidity and 24/7 market access.

Easy international transfers and rapid settlements.

Cons

High volatility and speculative risk.

Requires secure storage and risk management.

Regulations can evolve and affect availability.

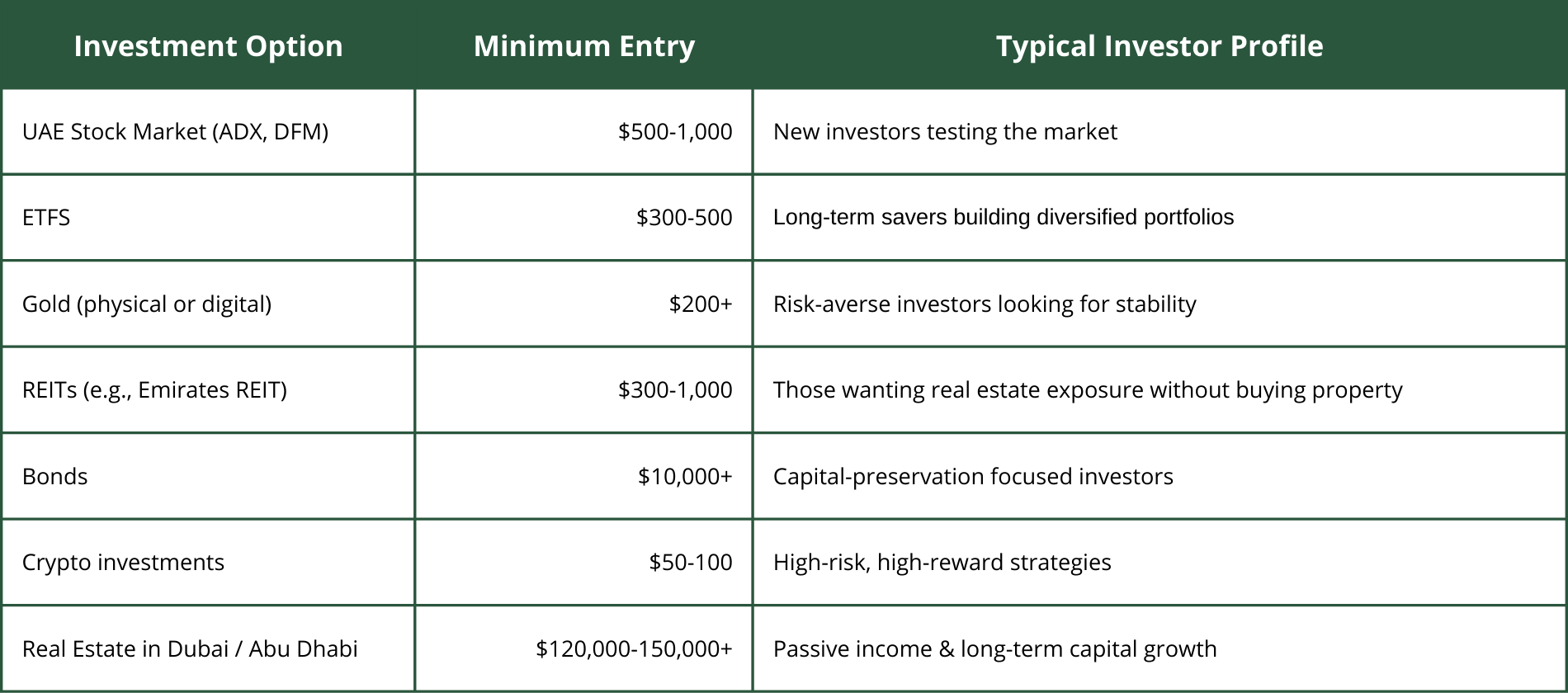

The Budget to Start Investing in the UAE

The minimum investment amount depends on what you choose — some options require only a few hundred dollars, while others are suitable for investors with larger budgets. Here’s a breakdown:

What budget gives you real impact:

$1,000–5,000 — best used for building diversified financial instruments: ETFs + gold + REITs.

$20,000–50,000 — great for starting an investment portfolio + possibly a small free-zone company for tax optimization.

$150,000+ — you can enter the Dubai property market and earn high rental yields.

If you don’t have a UAE bank account or need to use crypto for the payment, 1tab helps complete the transaction smoothly and legally.

UAE Citizenship for Investors

The UAE does not offer a direct citizenship-by-investment program. Naturalization is possible but reserved for exceptional cases, such as outstanding contributions to science, innovation, or culture.

However, foreign investors can obtain long-term residency, and for most expats, this offers all the practical benefits they need to live and invest in the country long-term.

You do not need to be physically in the UAE full-time. The visa remains valid with at least one entry every 6–12 months, depending on visa type.

For real estate and crypto investors, 1tab streamlines the process, simplifies it, and ensures full compliance. We help you issue a Manager’s Cheque remotely so that you can pay any developer in Dubai or Abu Dhabi in AED, USD, or even crypto. Submit a request, provide transaction details, transfer your funds, and receive the cheque securely.