How to Cash Out Cryptocurrency Legally And Safely In 2026

Legal and cost-effective ways to convert Bitcoin and other crypto into cash or transfer them to a card

This guide covers safe and practical ways to turn crypto into cash in different countries, including online and offline exchanges, peer-to-peer platforms, crypto ATMs, and crypto cards — all with a focus on legal compliance, reasonable fees, and minimizing risks.

Cashing out crypto doesn’t have to be complex or risky, especially if you’re dealing with large amounts or international transfers. 1tab is a cryptocurrency exchange and cross-border payment service that enables users to quickly and legally convert USDT, BTC, or ETH into fiat, send transfers, and pay invoices in over 40 countries. Use our Telegram bot to send your request and get support at every step.

Online and Offline Crypto Exchanges

Crypto exchanges remain one of the most common and reliable options for cashing out. They support a variety of payout methods and handle both small and large transactions. You can choose between online platforms or offline services, depending on what’s available in your area and how you want to receive your funds.

Online Exchanges

Platforms like Binance, Kraken, and Bitstamp allow you to sell crypto and get money sent directly to your bank account or card. These platforms are easy to use, offer fair exchange rates, and let you choose how you want to receive your money.

To ensure security and compliance, you’ll complete identity verification. These exchanges follow local rules, so you can cash out your crypto legally and without any hassle.

If you’re looking for other exchange options, websites like BestChange can help you compare rates, fees, and user reviews across dozens of verified platforms. This is a useful tool for finding reliable online or offline exchanges in your region. 1tab is also listed on BestChange, so you can easily check our current rates and reputation there.

BestChange Crypto Exchange Listing

Cryptocurrency exchange methods vary globally:

In Russia transactions often take place in private offices, ensuring client confidentiality.

Countries like Georgia, Armenia, Turkey, and Dubai have exchanges operating from openly branded offices, reflecting a more progressive stance on cryptocurrencies.

In Europe and the US, courier services are common, delivering cash to clients at their preferred locations.

Exchanges charge a commission for their services, which can vary. Additionally, many exchange points set limits on minimum and maximum transaction amounts.

Crypto Cards

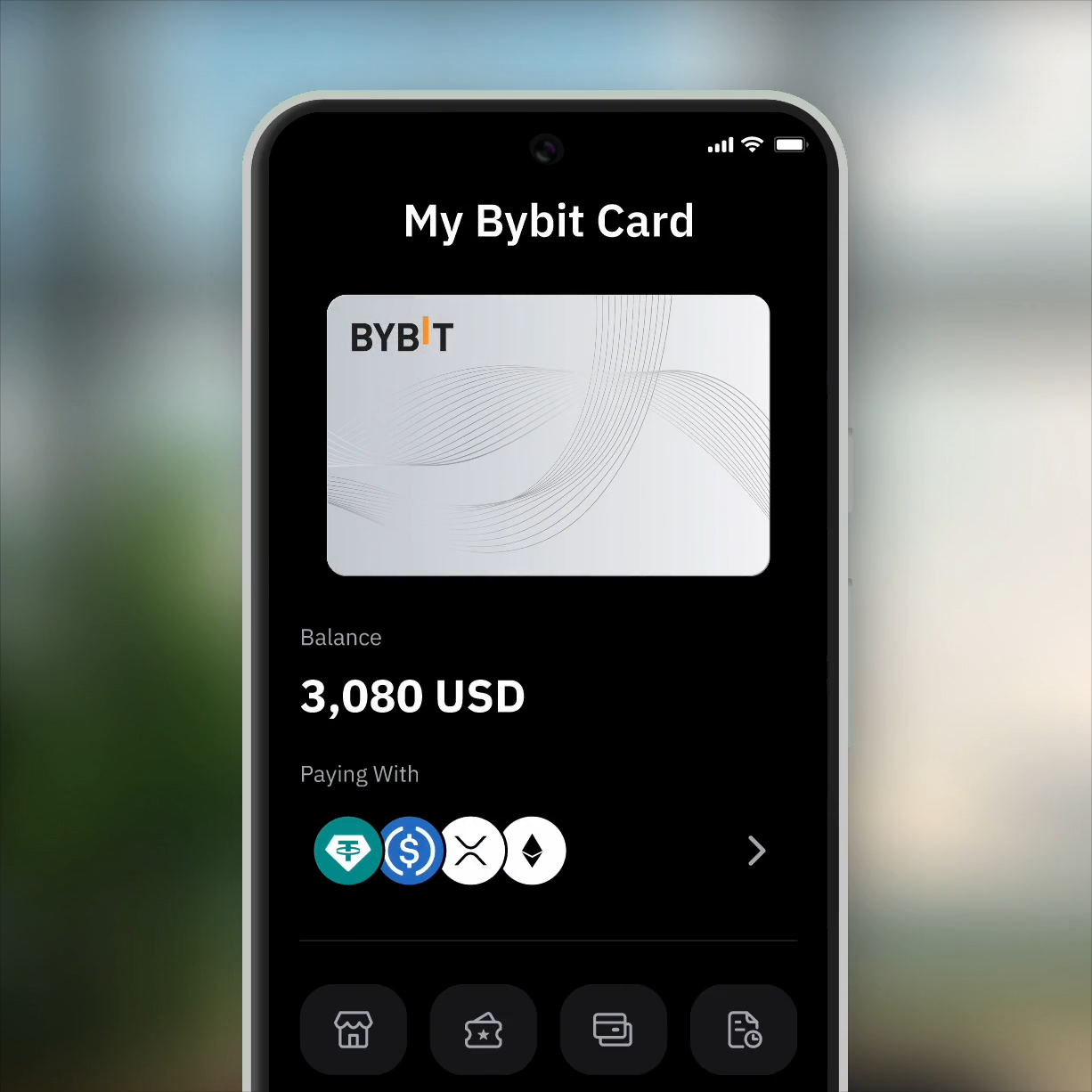

Coinbase, Bybit, and Crypto.com also offer crypto debit cards. They let you convert crypto to fiat within the platform and withdraw funds directly from ATMs or pay in stores and online.

The Bybit Card (MasterCard) lets users spend crypto and fiat directly from their Bybit account anywhere MasterCard is accepted, including online and via Google Pay, Apple Pay, and Samsung Pay. It supports BTC, ETH, XRP, USDT, USDC, and TON, with one primary fiat currency depending on the country. Users can choose a free virtual card or a physical card for $10.

Key fees:

0.9% crypto-to-fiat conversion,

2% fiat exchange,

2% ATM withdrawal (if over $100/month).

Spending limits reach $5,000 per day and $25,000 per month. Cashback ranges from 2% to 10%, with up to 100% on select partners. The card is available in EEA countries, Switzerland, Australia, Brazil, Argentina, and AIFC.

My Bybit Card App

The Coinbase Card is a Visa debit card that enables users to spend cryptocurrencies or fiat currency directly from their Coinbase account at any merchant accepting Visa worldwide. It offers up to 4% cashback in various cryptocurrencies, including Bitcoin and Ethereum, with rewards varying based on the chosen crypto, and is compatible with Apple Pay and Google Pay.

It doesn’t have any annual or foreign transaction fees; however, a 2.49% fee applies when spending cryptocurrencies due to conversion costs. To avoid this fee, users can opt to spend USD or the stablecoin USDC. ATM withdrawals are free up to $1,000 per day.

The card is available to verified users in the U.S. (excluding Hawaii), the UK, and several European countries.

The Crypto.com Visa Card is a prepaid debit card that allows you to spend cryptocurrencies or fiat currency at any merchant accepting Visa worldwide. It offers multiple card tiers, each with varying benefits and CRO staking requirements. Cashback rewards range from 1% to 8%, depending on the card tier and staking amount.

Higher-tier cards provide additional perks such as rebates on subscriptions like Spotify, Netflix, Amazon Prime, and X Premium, as well as access to airport lounges through LoungeKey™.

There are no annual or monthly fees, and users can manage their card through the Crypto.com app, which allows for easy top-ups using crypto or fiat. It’s important to note that staking CRO tokens is required to unlock higher-tier benefits, and unstaking may result in a loss of these perks. The card is available in various regions, including the US, UK, EU, Australia, and Brazil.

Offline Exchanges

In countries with more relaxed crypto rules — like Georgia, Turkey, the UAE, or Armenia — you can visit a local office to exchange crypto for cash. Some services also offer courier delivery.

Benefits:

You don’t need to involve banks, which helps avoid delays, frozen accounts, or questions about the source of funds.

These exchanges typically offer a higher level of privacy since you’re dealing directly with the service and not through automated platforms.

It’s one of the best options for large transactions — offices can handle amounts that would be flagged or restricted elsewhere.

Before you go, check the company’s reviews, fee structure, and transaction limits. Stick to verified services only.

Cashing Out Using 1tab

If you’re looking for a reliable offline exchange, 1tab is a trusted option. We help individuals and businesses cash out crypto legally in 40+ countries. 1tab supports BTC, ETH, and USDT with a minimum transaction of $5,000.

You can choose how to receive your money: direct transfer to a bank card, in-person cash pickup, or secure courier delivery. We offer both convenience and full compliance with local regulations.

How to cash out cryptocurrency via 1tab

Submit a request on our website or in Telegram bot. Choose the cryptocurrency, amount, and your city and country. If you don’t see your country in the list, contact our manager.

Provide transaction details: coin type and amount, preferred payout method, and your payout location.

Complete fast identity verification. You’ll need to upload a passport or government-issued ID, take a selfie, and fill out a short form with basic personal details.

Confirm terms. Our manager will contact you to confirm the rate, fee, and timing. The rate is fixed at this stage.

Transfer crypto and receive fiat. Send the crypto to a secure wallet. After confirmation and checks, the fiat is sent or delivered.

1tab Client Use Cases

1tab has been working with cryptocurrency since 2022, with over 30,000 successful transactions to date.

Our clients often include sole proprietors, self-employed individuals, and business owners who accept cryptocurrency as payment for their services or use it to make international purchases.

For instance, our client Alina purchases luxury clothing in Europe but resides in Russia. We offer Alina several solutions. We facilitate transferring funds from her Russian cards to a Georgian account using cryptocurrency, enabling her to pay for goods directly. Alternatively, if Alina requires cash, we arrange for euros to be available for pickup at one of our European offices.

Another example is our client in the international car import business. To pay suppliers and cover other expenses, he needs regular access to funds in Georgia. We help him transfer cash using cryptocurrency as an intermediary, ensuring swift and secure transactions.

Evgenia, our realtor partner, assists clients in purchasing Georgian real estate. Recently, she had a client requiring a large transfer from Georgia to Kazakhstan for an apartment purchase. We helped Evgenia complete this transaction by converting cash in Georgia to crypto and then to Kazakhstani fiat.

Apart from business clients, we also cater to individuals with personal cryptocurrency needs. 1tab assists global travelers seeking to cash out digital currency in various countries, as well as those making large international transactions — such as purchasing a vehicle or real estate.

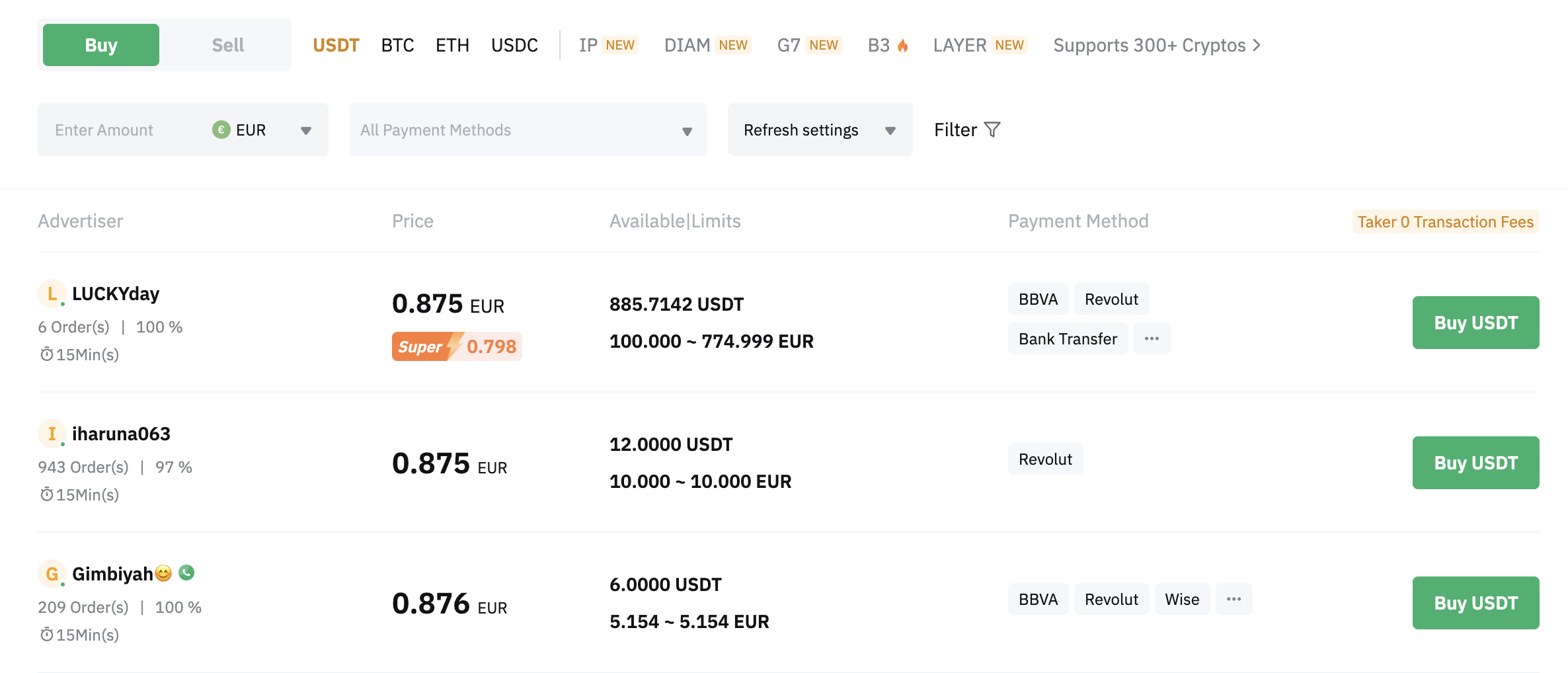

P2P trading

Peer-to-peer (P2P) platforms connect people who want to buy or sell crypto directly:

You create your own offer or respond to someone else’s.

Once both sides agree on the terms, the platform locks the crypto in a secure escrow system.

The buyer sends the payment using a method you both chose: a local bank transfer, an online wallet, or another available option.

After you confirm that the money has arrived, the platform sends the crypto to the buyer.

Popular P2P services include Binance P2P, OKX P2P, Bybit P2P, and Paxful.

Bybit P2P Platform

Pros of P2P:

Low or no platform fees — most P2P platforms charge little to no commission for transactions.

Multiple local payment options — users can pay or get paid via bank transfers, mobile wallets, cash deposits, or even in-person payments, depending on the country.

No third-party intermediaries – the transaction happens directly between buyer and seller, which gives more control and flexibility.

Risks of P2P:

Fake payment confirmations — some buyers may send fake receipts or screenshots to trick sellers into releasing crypto before payment is received.

Fraud and account theft — without using trusted platforms and escrow, you risk interacting with scammers or compromised accounts.

Longer transaction times — P2P deals often require both parties to agree manually and confirm payment, so the process can take hours instead of minutes.

Only use platforms with escrow and always verify payments before releasing your crypto. Check the user’s rating and transaction history.

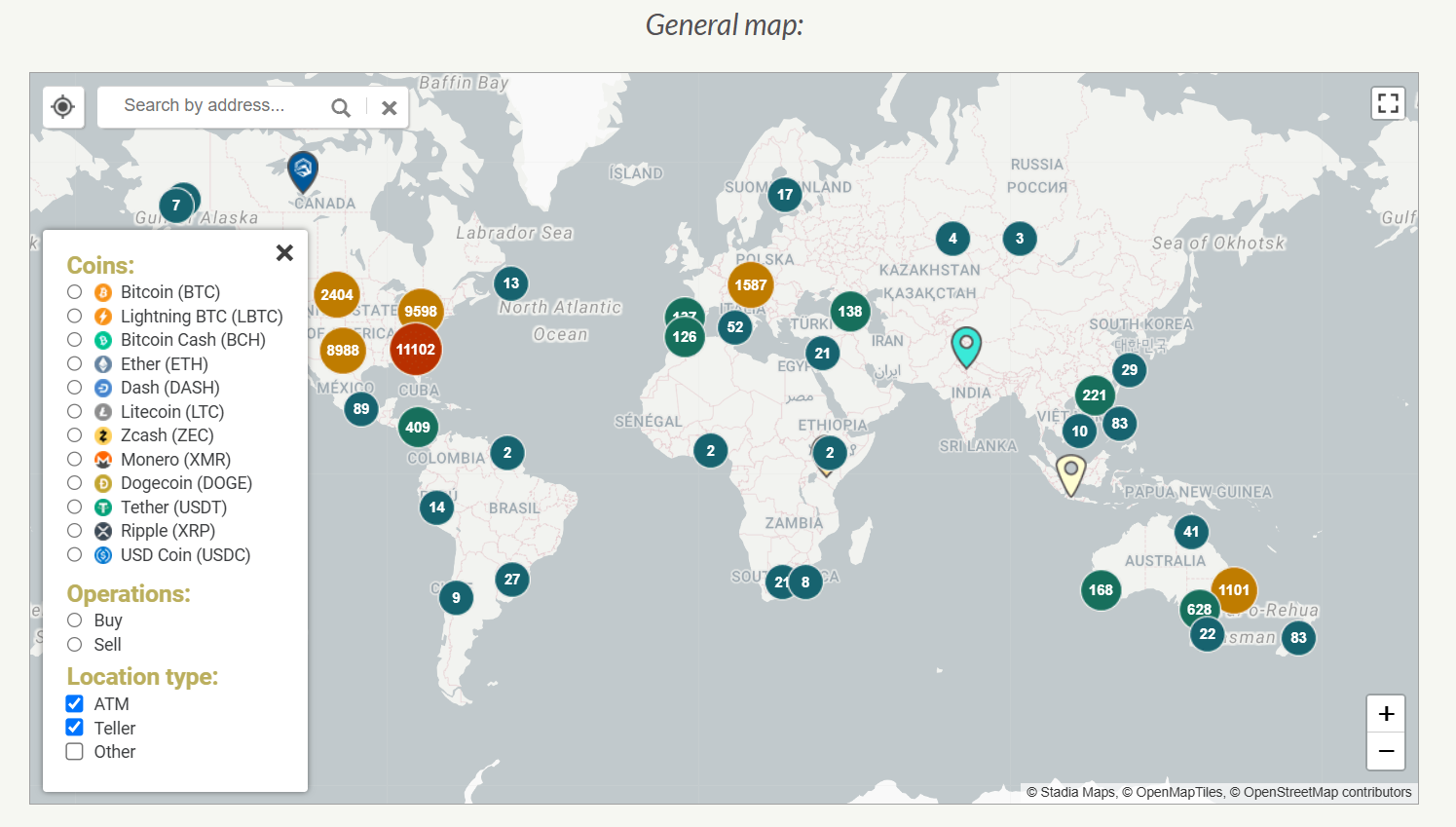

Crypto ATM

Crypto ATMs allow you to send cryptocurrency and withdraw cash on the spot, making it easy to exchange small sums. You send your coins to the machine’s address and receive fiat after the transaction is confirmed.

You can find nearby ATMs using platforms like CoinATMRadar, which show locations, supported coins, fees, and any ID requirements.

Pros:

Fast and convenient – ideal for quick cash withdrawals without waiting for bank approvals or platform transfers.

No need for a bank account — you don’t have to link a card or use traditional banking services to receive fiat.

Easily accessible – located in public places like malls, airports, and stores, many operate 24/7.

Cons:

High transaction fees – most machines charge between 8% and 11% per operation, which is significantly higher than online exchanges.

Daily withdrawal limits – many ATMs cap withdrawals at around $10,000, making them unsuitable for large transactions.

KYC requirements for higher amounts – if you’re exchanging over $3,000, you’ll usually need to scan your ID and verify your identity.

Watch out for fake QR codes or tampered machines and double-check the screen before sending any crypto.

Common Risks When Cashing Out Crypto and How to Avoid Them

Cashing out cryptocurrency can be straightforward — but it’s not without risks. Fraud, poor exchange practices, and legal pitfalls are common in the industry. Below are some of the most frequent threats and how to protect yourself.

Phishing attacks. Scammers often create fake websites or mobile apps that closely resemble popular exchanges or wallets. Their goal is to trick users into entering login credentials or sharing private keys. To stay safe, always double-check website URLs — make sure they start with “https” and are spelled correctly. Avoid clicking on links sent via unsolicited emails or messages, and stick to trusted, verified platforms.

Fake P2P traders. These scammers may use forged bank receipts, hacked accounts, or stolen identities to convince sellers that payment has been made — only to vanish with the crypto. You can reduce this risk by using platforms with escrow services, verifying every detail of the transaction, and avoiding offers that seem unusually generous or too good to be true.

Untrustworthy exchanges. Some services advertise attractive exchange rates, but later apply hidden fees, delay payouts, or simply refuse to complete transactions. Before using an exchange, do your homework: read user reviews on aggregator sites like BestChange and prioritize platforms that are licensed or have a long-standing positive reputation.

ATM fraud. Criminals may tamper with crypto ATMs by placing fake QR codes, installing card skimmers, or even hacking the software. To avoid falling victim, only use ATMs listed on reputable platforms like CoinATMRadar, inspect the machine before use, and never scan unfamiliar QR codes or trust random stickers placed on the device.

For larger or international transactions, 1tab offers more control, faster and safer payouts, and support in complex cases. Leave a request below to exchange your crypto securely.