How to Cash Out Large Amounts of Cryptocurrency in Different Countries

A guide to cashing out Bitcoin, USDT, and other cryptocurrencies for individuals

Need to withdraw large amounts of crypto ($5,000+)? Whether you receive your salary in crypto, invest, or want to transfer your crypto funds, 1tab, a cryptocurrency exchange and cross-border payment transfer service, has prepared detailed instructions to help you navigate this process.

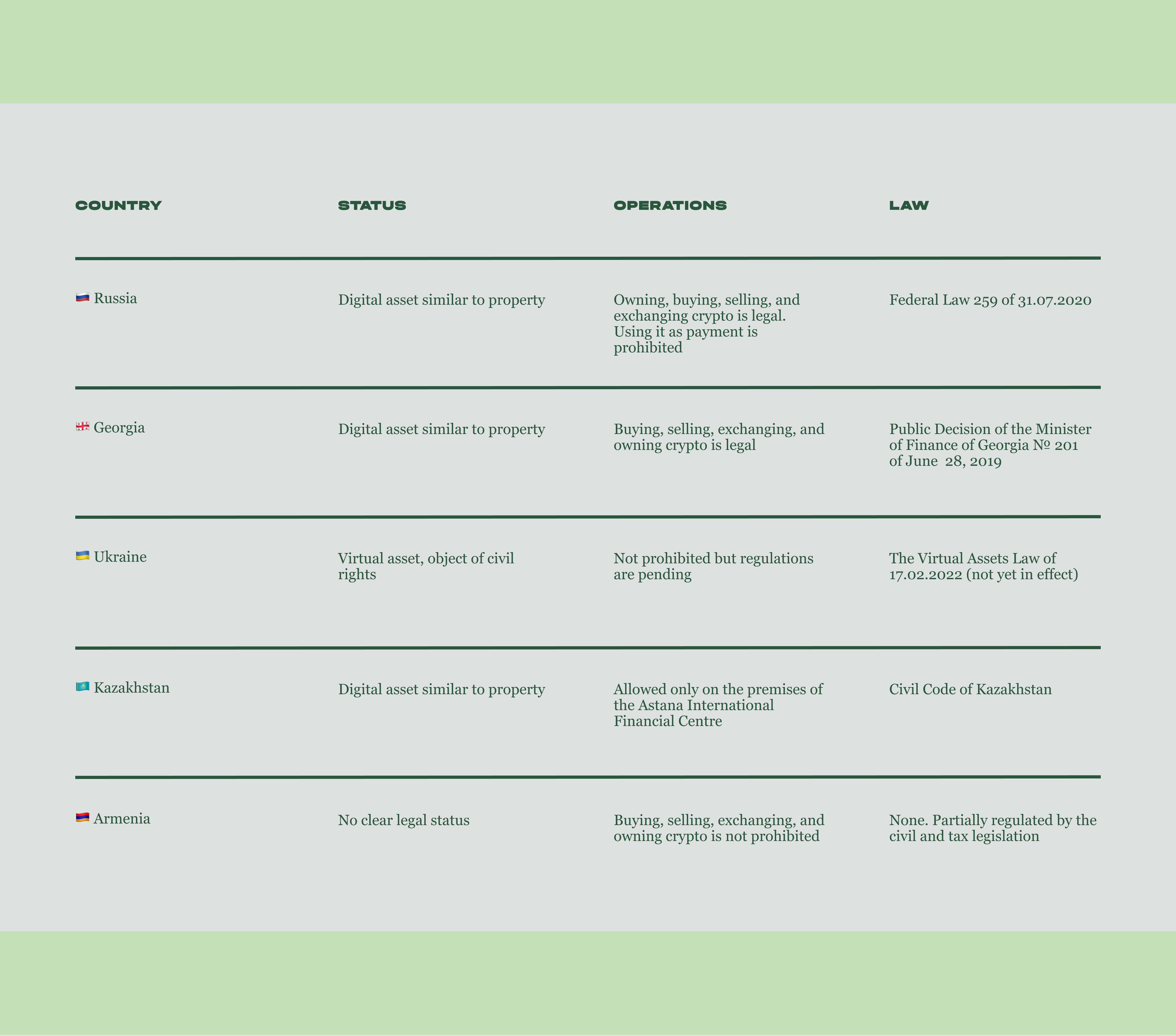

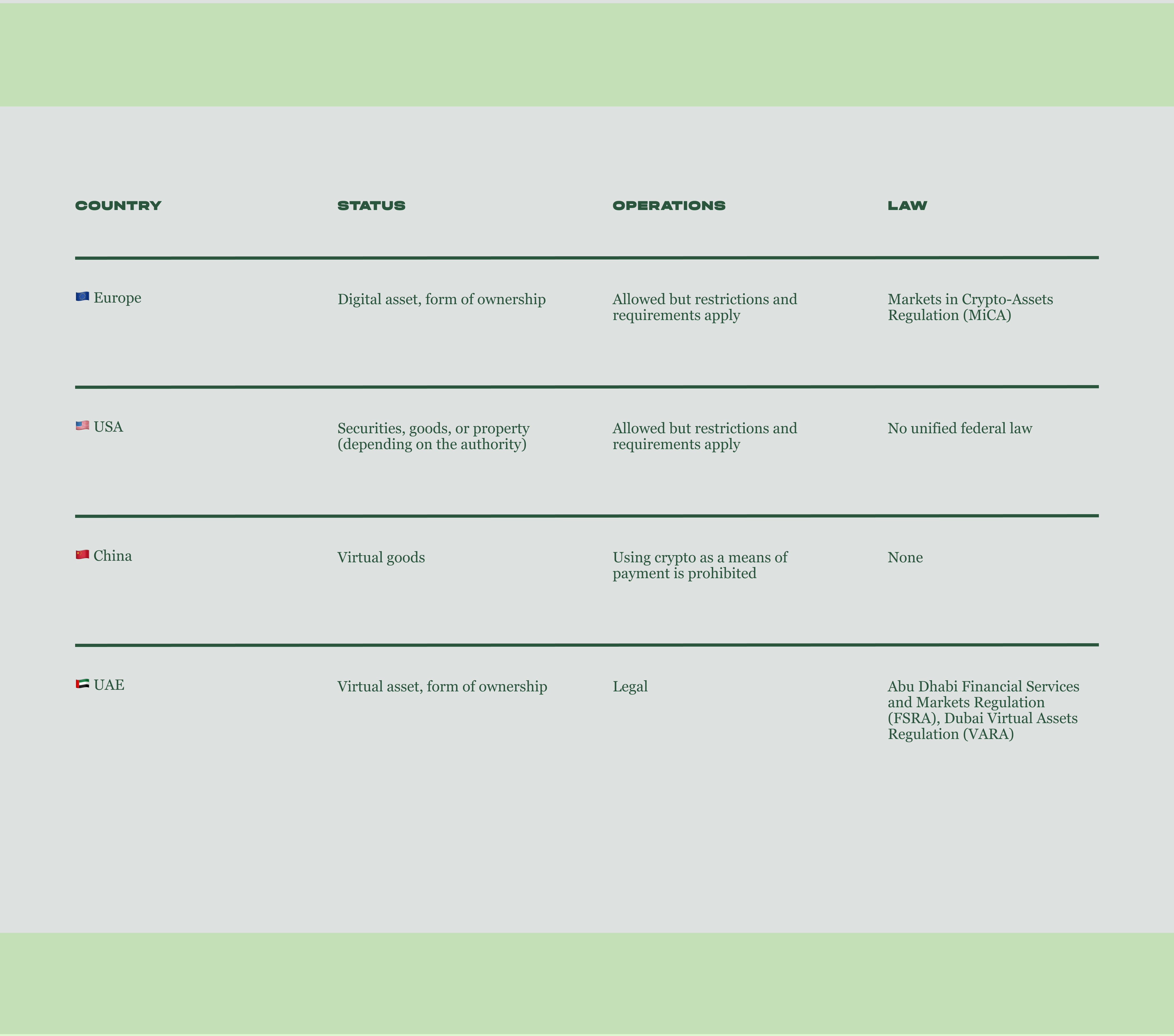

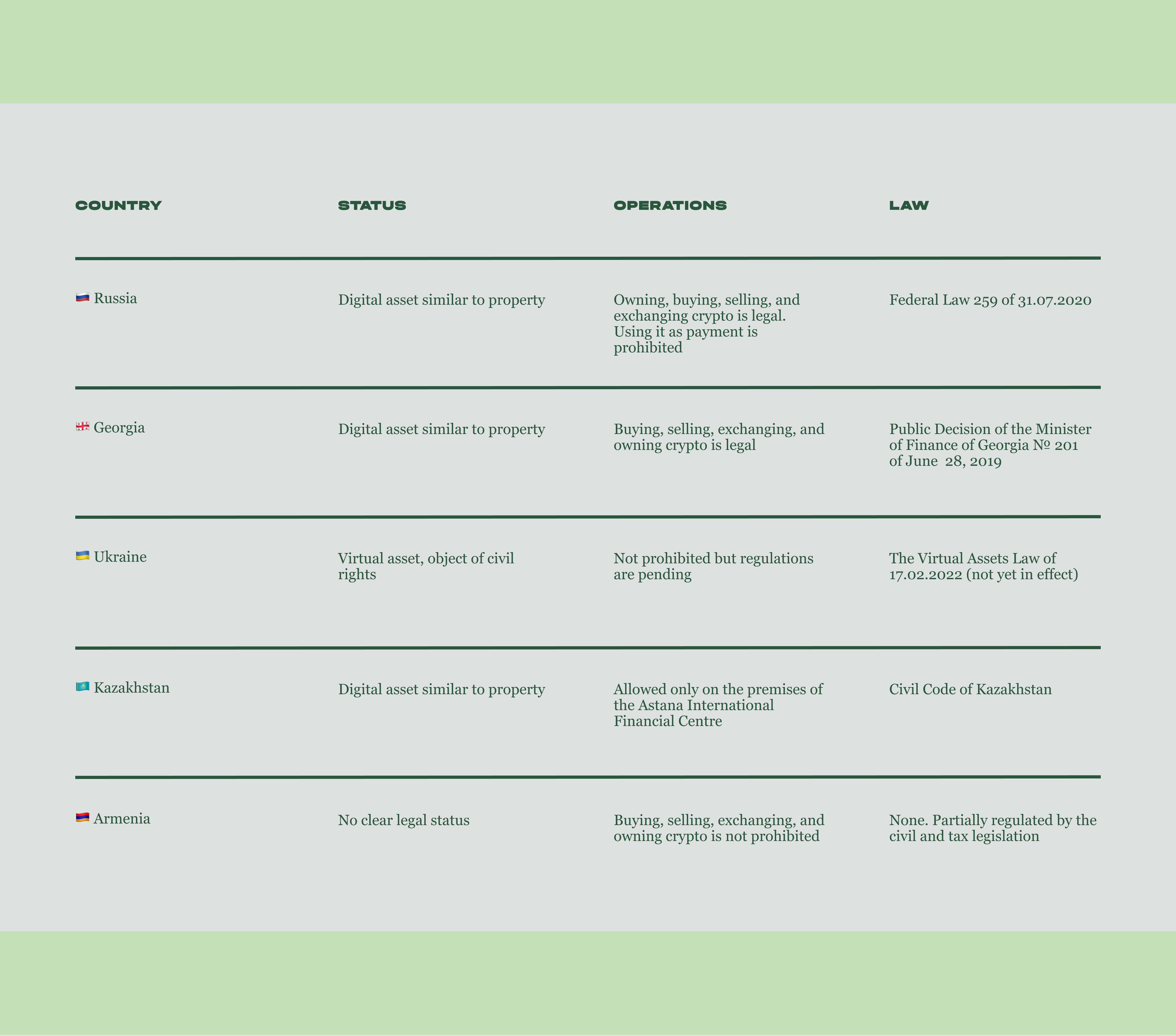

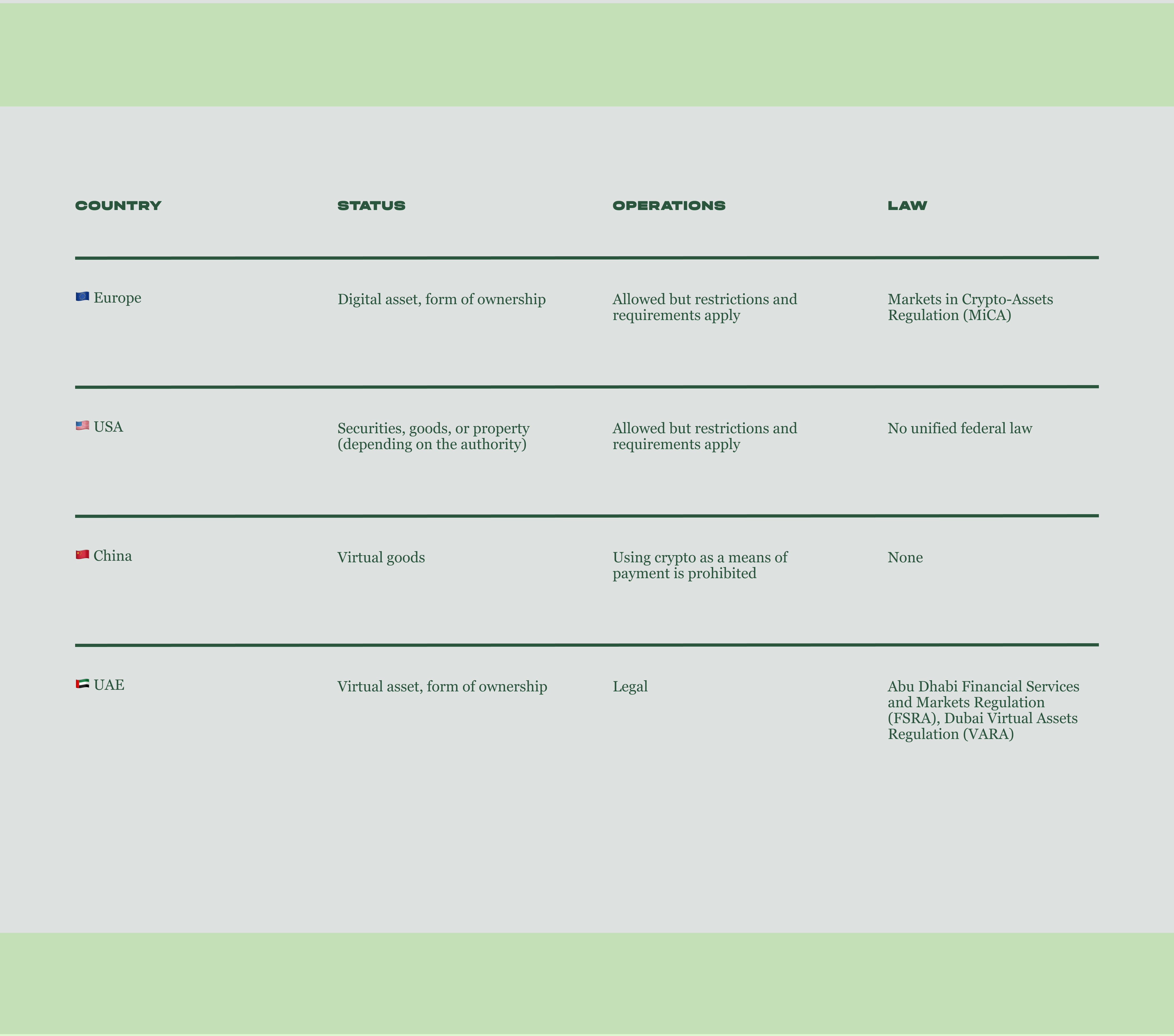

Is it legal to exchange large amounts of crypto

Exchanging cryptocurrency for fiat (cash or digital money) is legal in most countries, but their regulatory approaches vary significantly. There is no unified global framework, and the situation remains fluid as governments continually update their regulations to address this evolving space.

The European Union has approved the Markets in Crypto-Assets Regulation (MiCA), unifying cryptocurrency rules across member states. In contrast, China has prohibited cryptocurrency operations, including mining and trading. Meanwhile, El Salvador has recognized Bitcoin as a legal tender alongside the US dollar.

Georgia and CIS countries allow cryptocurrency withdrawals, although with specific requirements. When exchanging cryptocurrency for cash through exchange offices or P2P platforms, individuals must undergo Know-Your-Customer (KYC) verification. This typically involves submitting an identity document and, in some cases, providing proof of income source and residential address. Cryptocurrency taxation remains unregulated in these regions, but authorities are actively exploring the introduction of taxes on these transactions.

In Russia, cryptocurrency is not recognized as a legal tender, although individuals can still buy, sell, and exchange it. A significant challenge arises from sanctions, which have led most crypto exchanges and exchangers to restrict access for Russian users. Although some platforms remain accessible, converting cryptocurrencies to rubles may become increasingly difficult.

Cryptocurrency regulation is rapidly evolving in most countries. As a result, governments are reviewing existing laws, may update them, or introduce new ones.

Crypto withdrawal methods for individuals

Cashing out crypto is legal in most countries, although with certain restrictions. The process varies depending on country-specific regulations, withdrawal methods, and desired currency. Furthermore, legislation and regulation are constantly changing. If you plan to withdraw a large amount ($5,000 or more) and want to mitigate risks, consider consulting specialists for personalized advice.

To withdraw your cryptocurrency, start by deciding whether to exchange it for cash or digital money. Once you have made that decision, choose a suitable withdrawal method.

Cryptocurrency → Digital money

You can convert crypto into digital money through various channels, including crypto exchanges, P2P platforms, and crypto exchangers.

International exchanges like Binance, Kraken, and Coinbase allow selling cryptocurrency and withdrawing funds to bank accounts or cards. However, these services are currently unavailable for Russians. Local exchanges may sometimes offer more favorable conditions for domestic users. In the P2P section, you can find buyers who will transfer money directly to your bank account or card in exchange for crypto. This method can be more profitable than transactions on the exchange itself, but it requires caution when choosing counterparties. Online exchangers provide another option, allowing you to exchange crypto for fiat money and withdraw it to bank accounts or cards.

However, all these methods have a significant limitation: most banks are wary of cryptocurrency transactions and use a risk-based approach for clients doing cryptocurrency transactions. Banks may request extra documentation or even block your account if your transactions raise suspicion (e.g., recurring large withdrawals or frequent transactions with unfamiliar counterparties). Situations like this are common in many countries. In Russia, banks are blocking cards, referencing Central Bank guidelines. Meanwhile, Georgian banks are freezing accounts, often citing compliance with international sanctions and anti-money laundering regulations, but sometimes without an explanation.

Banks may request documentation verifying the cryptocurrency origin, such as exchange transaction history. They may unblock your account after lengthy correspondence, but this is not guaranteed. Banks are more likely to cooperate if you conduct transactions transparently and legally. However, if you plan a large, one-time crypto cash-out, carefully weigh the risks. In this case, dealing in cash might be a safer option.

Cryptocurrency → Cash

You can convert cryptocurrency into cash in person or online using crypto ATMs and physical exchange points. These services typically charge a transaction fee. In most countries, exchangers operate legally, provided they hold a VASP (Virtual Asset Service Provider) license. However, high commissions in Europe and the USA often lead individuals to opt for peer-to-peer exchanges.

In Russia, cryptocurrency exchange operations remain unregulated by law and are thus allowed. However, a proposed bill submitted to the State Duma may limit the operation of crypto exchangers within the country.

You can withdraw large amounts in cash through an OTC (Over-The-Counter) transaction — a direct crypto purchase and sale transaction between two parties, bypassing crypto exchanges and platforms. To do this, find a reliable seller via specialized OTC platforms or 1tab service. Our network includes verified counterparties worldwide, offering office pickup or courier delivery of funds.

Converting cryptocurrency to cash provides autonomy from bank policies and eliminates account risks. Plus, it is faster — while bank transfers take hours or days, crypto ATMs and exchange offices dispense cash instantly.

1tab guide to exchanging large amounts of crypto

Submit a request on our website or via the 1tab Telegram bot.

A 1tab manager will contact you to discuss and confirm transaction details.

Send cryptocurrency or bring cash to complete the transaction.

Receive your funds through your preferred method: office pickup or courier delivery.

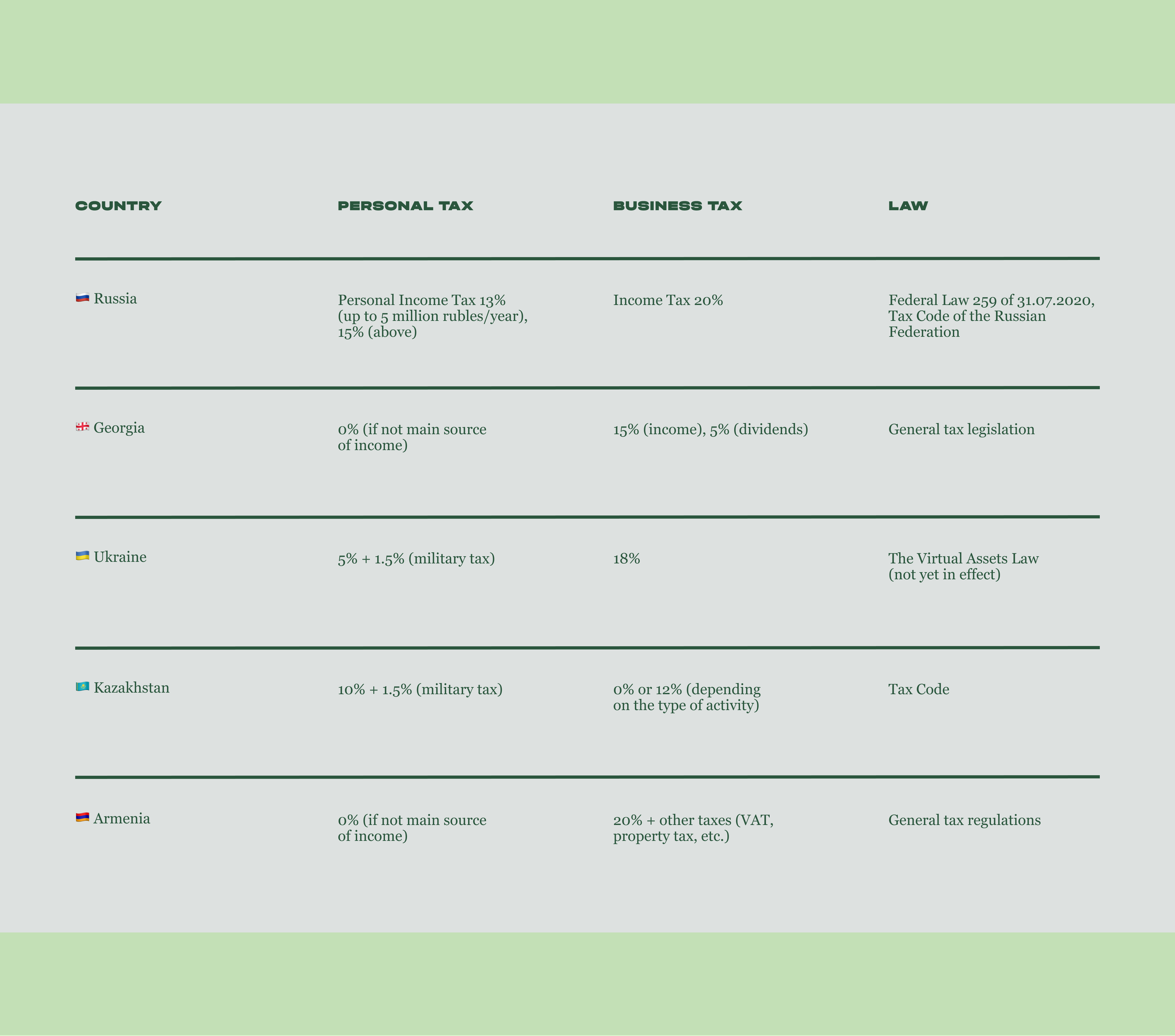

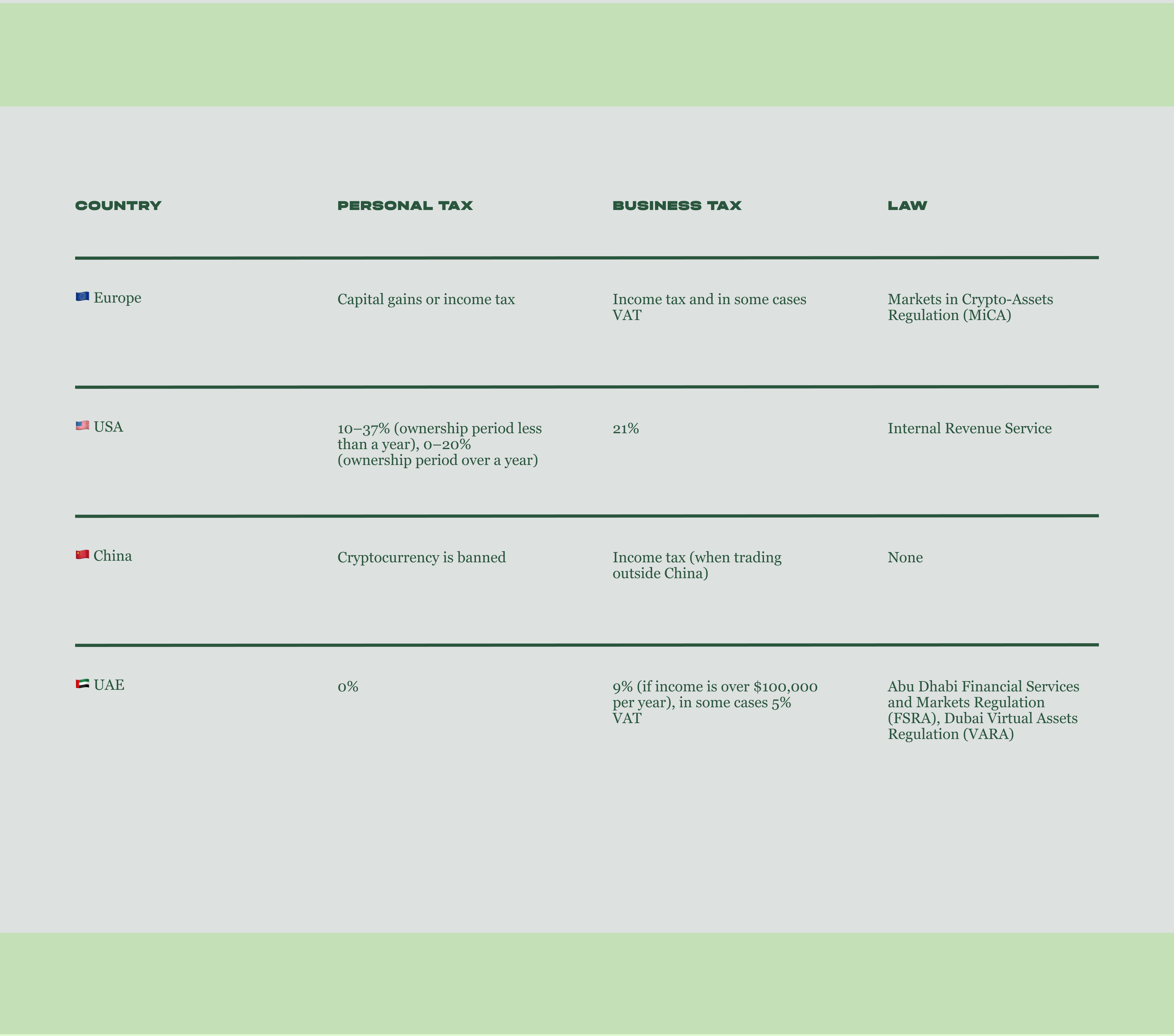

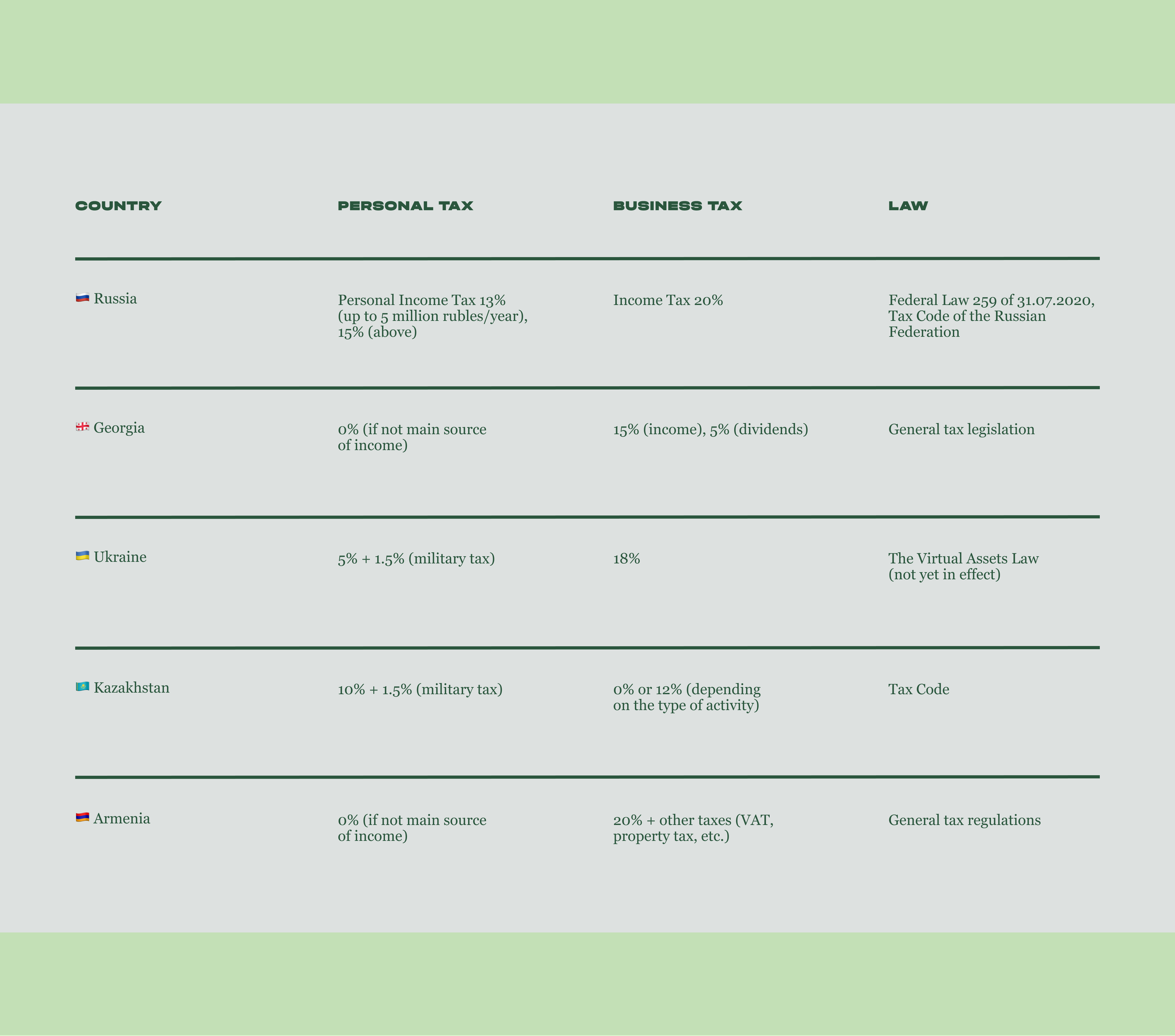

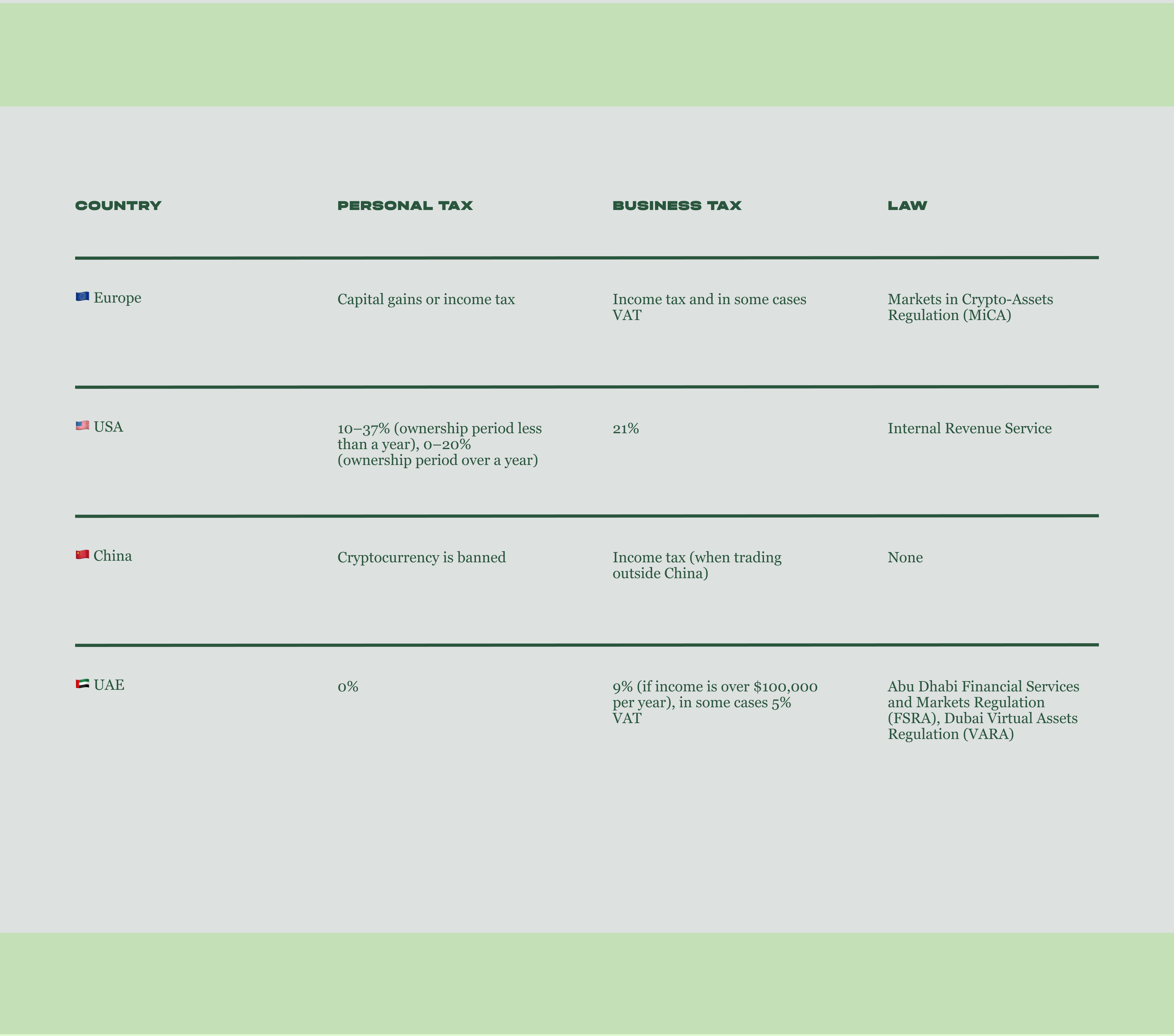

Crypto taxes and declaration requirements

Remember to factor in taxes. Cryptocurrency transactions are taxable and must be declared per the tax laws of the country where the transaction is executed.

In most countries, cryptocurrency is considered property or an asset, not currency. This means crypto transactions are taxable as income or subject to capital gains tax if profitable. Any income derived from these transactions must be declared.

Cryptocurrency taxation varies significantly worldwide. For instance, Japan imposes a capital gains tax of up to 55%, while Germany exempts crypto held for over a year. However, some countries still lack clear guidelines. To ensure compliance, it is recommended to declare crypto income and consult tax experts, as regulations are constantly changing.

Characteristics of bitcoin, usdt, and altcoin withdrawals

When cashing out cryptocurrency, consider the type of coin you are selling: Bitcoin, USDT, or Altcoins (all other cryptocurrencies besides Bitcoin).

Bitcoin (BTC) is one of the most popular and widely accepted cryptocurrencies, easily exchangeable for cash at crypto ATMs, exchange offices, and P2P platforms. However, withdrawal fees may be higher due to the high cost of transactions on the Bitcoin network. Transactions typically take several minutes to several hours to process.

Tether (USDT) is a stablecoin pegged to the US dollar. Like Bitcoin, USDT can be easily exchanged for cash at various locations. USDT withdrawal fees are generally lower compared to BTC due to the cheaper transaction costs on the Ethereum and Tron networks, where USDT is primarily issued. USDT transactions are typically faster than Bitcoin.

Other cryptocurrencies have limited direct cash exchange options. Typically, you’ll need to exchange Altcoins for BTC or USDT on a cryptocurrency exchange and then cash out the BTC or USDT. Withdrawal fees and cashing-out speeds vary.

Bitcoin has the highest liquidity among cryptocurrencies, making it easy to exchange for cash at competitive market rates. USDT also maintains considerable liquidity, particularly on major exchanges and platforms. In contrast, less popular altcoins often suffer from lower liquidity, resulting in less favorable exchange rates and difficulty finding buyers on P2P platforms.

Potential risks and how to avoid them

To protect yourself from potential scams, thoroughly research and verify the reputation of exchangers or counterparties before making a cryptocurrency transaction. While selling through a reputable exchanger and receiving immediate cash reduces risk, due diligence is still necessary. Consult platforms like BestChange or bits.media to assess the exchanger’s credibility and read reviews.

Ensure you’re on the official website when using online cryptocurrency exchange services, especially in countries without physical exchangers. Be cautious of fake sites mimicking reputable exchangers to steal your data and funds. Verify the website’s authenticity by checking the URL for typos or slight variations, ensuring it uses HTTPS protocol (look for the lock icon in the address bar and the “https://” prefix). You can also verify the website’s safety using tools like Google Transparency Report.

Dealing directly with a counterparty can be risky. Make sure to research the user’s reputation and consider employing escrow services that secure your cryptocurrency until the cash receipt is confirmed. When meeting buyers, choose safe public spaces.

When converting cryptocurrency to digital money, be aware that many banks may be suspicious of such transactions and potentially block your accounts or cards. If you still require digital funds, contact our specialist for guidance.

Regulatory authorities may view crypto-cash exchange as money laundering, especially for large withdrawals. To avoid charges, be prepared to prove the legal origin of the cryptocurrency. Keep all relevant documents, including certificates confirming the source of income, receipts, invoices, and contracts documenting the purchase of cryptocurrency.

Declare your cryptocurrency income and pay applicable taxes to avoid fines or potential criminal prosecution and safely use the income received from your crypto activities.

Finally, protect your cryptocurrency by using reliable wallets, enabling two-factor authentication, and keeping private keys confidential.

Withdrawing large amounts of cryptocurrency isn’t too complex. Individuals can cash out Bitcoin, USDT, or other cryptocurrencies through cryptocurrency exchanges via bank transfer, crypto exchangers, P2P platforms, or crypto ATMs. Ultimately, the best method depends on your needs and priorities, such as transaction speed, anonymity, fees, and legal considerations.