What is the Manager’s Cheque in Dubai, UAE

Guidance on Bank Guarantees in the UAE

In the UAE, most high-value transactions like real estate and luxury goods involve secure financial instruments like the manager’s cheque. They are convenient and necessary for buyers and sellers dealing with more considerable sums. The manager’s cheque is the backbone of Dubai’s financial transactions, addressing the risk in significant transactions and ensuring the immediate availability of funds.

In all large transactions like property transactions, sellers often insist on a manager’s cheque because it guarantees payment clearance and eliminates the risk of processing delay and insufficient funds, as with personal cheques. Similarly, it is preferred in personal transactions like payments for cars, mortgages, and other high-value personal goods due to its bank-backed guarantee and widespread acceptance. The manager’s cheque has become a primary method of secure commerce in the UAE.

We’ll unpack the manager’s cheque — how it works, what gives it an edge, and why it’s a trusted way to handle hefty transactions confidently.

If you need a manager’s cheque in Dubai, we can assist with the process through our network of trusted payment agents. Reach out to our manager on Telegram for a consultation.

What is the Manager’s Cheque

A manager’s cheque, also referred to as a Cashier’s cheque or a bank draft within Dubai, is a type of bank-issued payment instrument that guarantees the transfer of a specified amount to a designated recipient.

Unlike personal cheques, a manager’s cheque is prepaid and drawn directly from the bank’s account, ensuring the availability of funds. This makes it a highly reliable form of payment in Dubai and across the UAE.

Banks do not need a lot of time to issue a manager’s cheque. To meet consumer needs, banks have made it a quick process. They take 10–30 minutes to verify the details and get the cheque.

Key Characteristics of a Manager’s Cheque

Issued by the bank

The bank guarantees the payment to eliminate risks like insufficient funds, which are common with personal cheques. Plus, it is also time efficient.

Non-revocable

After issuance, it cannot be canceled without the consent of all parties. Non-cancellation with the consent of each party is what makes it a trustworthy option for real estate and high-value goods.

Secure

Carrying large sums of cash is risky. It eliminates that risk and provides much-needed security.

How Do Manager’s Cheque Transactions Work

Here are the steps involved in using a manager’s cheque:

Application. To apply for the manager’s cheque, you need to have enough funds in your bank account or cash. The bank verifies and reserves the required amount.

Issuance. Before processing the request. The bank verifies all details. Afterward, the bank issues the cheque with the recipient’s name, amount, and official signature.

Handover. The banks offer the option to collect the cheque in person or via delivery.

Purpose of Manager’s Cheque

Real Estate and Luxury Purchases

Whether buying a new home, an expensive car, or an exclusive piece of jewelry, manager’s cheques bring peace of mind to both buyer and seller. Generally, such transactions are done with unknown people, and they cover the lack of trust element in such transactions.

Business and Rental Agreements

The manager’s cheque becomes a neutral guarantor in situations where trust has yet to be established, such as new rental agreements or business partnerships.

Corporate and Escrow Transactions

In corporate dealings such as mergers or acquisitions, where substantial funds are exchanged, the risk of bounced payments can derail trust, and to eliminate it, a manager’s cheque is a preferred option. Likewise, in escrow arrangements — where funds are temporarily held in trust until all parties fulfill their obligations — a manager’s cheque serves as a trusted and reliable tool to facilitate the transaction.

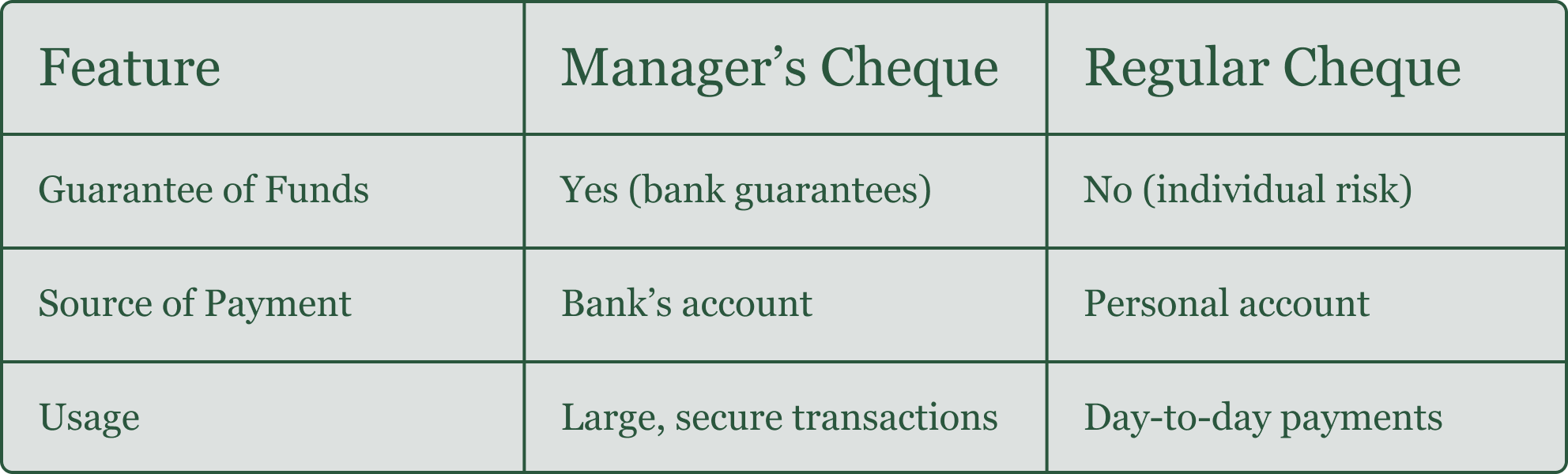

Differences from Regular Bank Cheques

The manager’s cheque differs significantly from regular personal cheques in the following ways:

Advantages of Manager’s Cheques

Immediate Availability of Funds. Funds are available almost instantly upon deposit, minimizing clearing delays.

Safety and Security. A safer alternative to carrying large sums of ash; can be replaced if lost or stolen.

Widespread Acceptance. Guaranteed by the bank, widely accepted for high-value transactions.

No Clearing Wait Time. Recipients access funds immediately as the bank ensures availability. Cheques deposited by 10 a.m. often clear by 5 p.m. the same day, which is ideal for large deals like real estate.

Reliability and Trustworthiness. They are considered trustworthy because they remove the risk of bounced payments due to insufficient funds.

How to Obtain a Manager’s Cheque in Dubai, UAE

Securing a Manager’s Cheque is essential for safe, smooth payments, especially in property transactions. Here’s how to do it step by step:

Select a Bank Carefully. Choose a reputable bank in the UAE that issues Manager’s Cheques. Consider convenience, fees, and whether they provide online services.

Check Your Account Balance. Ensure that your account has enough funds to cover the cheque. Some banks may require verification if you are not an existing customer.

Prepare Your Documents. Bring identification, such as your Emirates ID and passport, and any relevant details for the transaction, like property or recipient information.

Explain the Purpose. Inform the bank that the cheque is intended for a property deal or other significant payment. Staff will guide you through specific requirements.

Request the Cheque. Provide the exact amount and the recipient’s name. The bank will issue the cheque with its official seal and authorized signatures.

Pay the Issuance Fee. Banks charge a small fee, usually between AED 30 and AED 75, depending on their policy.

Review the Cheque Details. Double-check all information on the cheque, including the recipient’s name and amount, to avoid errors.

Receive and Safely Store the Cheque. Treat the Manager’s Cheque like cash. Keep it secure until the day of the transaction.

On the day of the transaction, present the cheque to the recipient. The payment is guaranteed, and the recipient can deposit or encash it immediately.

How Long Does It Take to Get a Manager’s Cheque

The time required to obtain a Manager’s Cheque in Dubai depends on whether you visit the bank in person or use online services. Typically, if you go to a branch during regular banking hours and have all necessary documents ready, the cheque can be issued immediately, often within a few minutes. Some banks may require additional verification for new customers, which can slightly extend the process.

For customers using online banking, some banks, such as Emirates Islamic Bank, offer the option to request a Manager’s Cheque digitally. In this case, the cheque is prepared by the bank and delivered to your registered address, which may take one to three business days depending on the bank’s processing and delivery schedule.

Manager’s Cheque Fees

When you request a Manager’s Cheque in Dubai, banks charge a small fee for issuing it. The amount usually ranges between AED 30 and AED 150, depending on the bank and the type of transaction. This fee covers the administrative work, verification of funds, and preparation of the cheque with the bank’s official seal and signatures.

Some banks may charge additional fees if you request the cheque online or ask for delivery to your registered address. To avoid surprises, check the fee structure with your bank before making a request.

Can I Get a Manager’s Cheque Remotely

Yes, you can request a Manager’s Cheque remotely through online banking with certain UAE banks. For example, Emirates Islamic Bank allows customers to apply for a cheque digitally and have it delivered to their registered address. To do this, log in to your online banking account, select the Manager’s Cheque option, and provide the necessary details, including the amount and recipient information.

Before submitting your request, make sure your account has sufficient funds and that your identification and transaction details are up to date.

How 1tab Could Help You with Manager’s Cheques

If you are not a UAE resident and don’t have a local bank account, you can contact 1tab — we’ll help you issue a Manager’s Cheque remotely. You can pay for it in any major currency or even with cryptocurrency.

How to get a Manager’s Cheque through 1tab:

Submit a request. Contact 1tab and describe what you need the cheque for — real estate, a vehicle, or another transaction.

Get verification. Our team will confirm the details and explain the process.

Transfer the funds. Send the payment in your preferred currency or in cryptocurrency.

Receive your cheque. 1tab issues the Manager’s Cheque on your behalf — ready to use anywhere in the UAE.

If you have any questions, please contact our manager on Telegram for a consultation or leave a request in the form below.

Is It Possible to Obtain a Manager’s Cheque Using Cryptocurrency Payments

In Dubai, certain service providers facilitate the conversion of digital assets like Bitcoin or USDT into fiat currency, which can then be used to obtain a manager’s cheque. 1tab offers services that allow clients to pay in Bitcoin and receive a manager’s cheque for the equivalent amount.

Nonetheless, this procedure consists of several stages:

Engage a Facilitator. Partner with a service provider that specializes in converting cryptocurrency to fiat currency and can issue manager’s cheques — for example, 1tab.

Compliance Checks. To comply with UAE regulations, you must go through Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Conversion Process. Transfer the agreed-upon amount of cryptocurrency to the service provider, who will convert it to the local currency.

Issuance of Manager’s Cheque. The provider will issue a manager’s cheque for the equivalent amount upon successful conversion and compliance clearance.

It’s crucial to note that not all banks in Dubai accept cryptocurrency directly. Therefore, utilizing specialized services is often necessary. 1tab can exchange your crypto to fiat or accept crypto directly for issuing a manager’s cheque. Leave a request in our Telegram bot to book a deal.

Manager’s Cheque Clearing Time

After the recipient receives a Manager’s Cheque, the next step is depositing it into their bank account. For cheques deposited within the same bank or banking group, funds often become available the same day or by the next business day.

If the recipient uses a different bank, the clearing process may take two to three business days, depending on interbank procedures. International deposits can take longer, as banks coordinate across borders.

Some banks also allow pre-notification of incoming cheques, which can speed up processing.

Post-Dated Manager’s Cheques in the UAE

The manager’s cheques are typically issued for immediate payment and are not intended to be post-dated. The bank guarantees the funds at issuance, ensuring the recipient can access them immediately upon deposit.

Therefore, post-dating a manager’s cheque is generally not practiced, as it would contradict the purpose of providing guaranteed immediate funds.

Assisting Non-Residents with Manager’s Cheques

If you don’t have a bank account in Dubai or face limitations as a non-resident, 1tab can help you acquire a manager’s cheque via their partners. In the UAE, there is no restriction on using manager’s cheques issued by third parties for real estate or other contractual transactions. This service typically costs about 1.5–2% of the cheque amount.

How the Process Works with 1tab

1tab simplifies the process of obtaining a manager’s cheque, offering a secure and hassle-free experience.

Here’s how it works:

Contact 1tab. Reach out to a 1tab manager to discuss your transaction terms and provide details such as the recipient’s information and the cheque amount.

Provide Identification. Submit your ID, and if you plan to transfer funds using cryptocurrency (e.g., Bitcoin or USDT), complete a KYC procedure and pass AML verification to comply with UAE regulations.

Transfer Funds. Transfer the required funds via your preferred method — whether cryptocurrency, cash, or wire transfer.

Cheque Issuance. 1tab’s partners in Dubai will apply to their bank, which will “freeze” the required amount in their account and issue a manager’s cheque.

Cheque Delivery. The manager’s cheque will be delivered to you or directly to the recipient, such as a real estate developer or seller, to facilitate the payment.

Cheque Deposit. The recipient deposits the manager’s cheque into their bank account. Within 24 hours, the funds are credited to their account, completing the payment securely and efficiently.

The 1tab Advantage

Generally, the biggest issue for foreigners is the requirement for a UAE bank account, and partnering with 1tab can solve this issue, enabling you to access secure payment solutions like manager’s cheques. Whether you’re purchasing a property, settling a contractual transaction, or making a high-value payment, 1tab ensures a smooth, fast, and safe process.

Due to their security and safety, managers’ cheques are becoming the primary instrument for executing big transactions in the UAE. The risk of bounced payments and insufficient funds was a much bigger issue earlier, but with manager’s cheques, transactions have become much smoother and safer. The process is simple and quick, making it a hassle-free experience for buyers and sellers.